As we head towards the end of Q1, we take a look at the products that have entered the marketplace in the first three months of 2024.

An increasingly fragmented global market, as well as rising prices and shrinking products have left consumers feeling undervalued and disillusioned with brands. With 37% of people worldwide feeling that many companies are prioritising higher profits over customer experience.

This has made creating engaging and relevant new products, that resonates with them, more challenging – one of the factors we’ve explored in our report How to Craft a Winning NPD Strategy in 2024.

So how has the food industry responded?

Well, it’s been an interesting three months for new product development (NPD). In the UK, there has been a massive new product push by Nestle, mandarin has stepped into the flavour space to replace the increasingly expensive orange, and ice-cream’s raspberry ripple has moved beyond the freezer aisle. Elsewhere in the US, it is in the non-alcoholic arena that has seen the most exciting new product developments. While in Australia, it’s the power of celebrity that has been influencing brand NPD investment.

Seasonal products

In the seasonal chocolate space, several UK brands have directly responded to the issue of consumers feeling “unloved” by producing larger eggs with added extras.

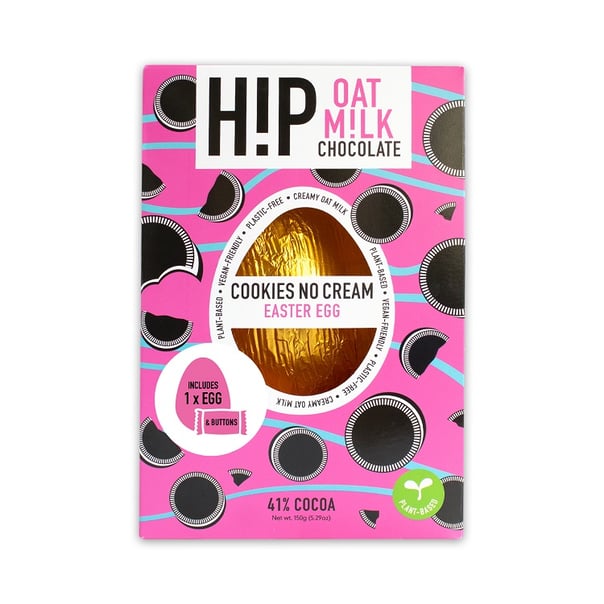

First up is alt milk chocolate brand Hip, which has introduced two new flavours - salted caramel and cookies no cream – to their oat milk chocolate egg range. So, what makes this new release noteworthy? Hip have bucked the shrinkflation trend and upgraded their offering, making the plant-based vegan-friendly eggs bigger and with added buttons.

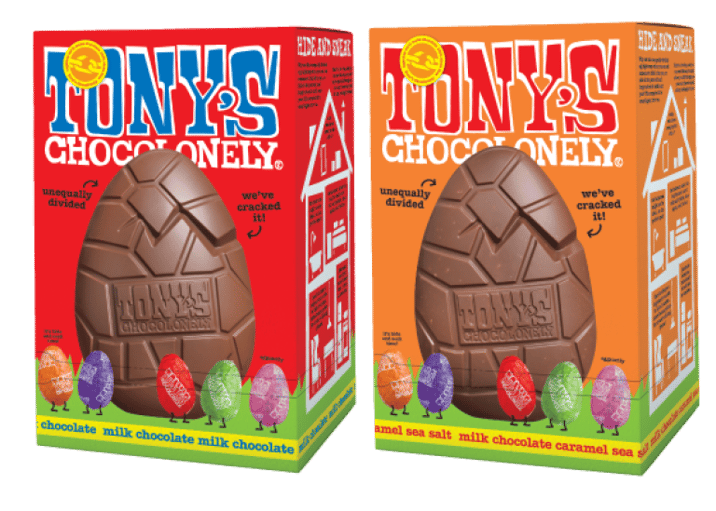

Ethical chocolate brand Tony Chocolonely’s has taken similar approach with its entry into the Easter egg space. The brand’s new Chunky Egg comes in milk and milk caramel salt and has a name that reinforces the idea that consumers are purchasing a substantial product for their money.

The nostalgia spend

In the UK, Nestle has invested in nostalgia in Q1, combining established products and consumer favourites to enhance the new product experience for shoppers. New launches Neapolitan Aero Melts, Raspberry Ripple Milky Bar Buttons and Cookie Dough Ice Cream Munchies all introduce tried and tested ice-cream flavour combinations to confectionery, while KitKat Chunky White with Lotus Biscoff taps into the enduring popularity of the little Belgian biscuit.

Elsewhere in the Australian market, it is the nation’s beloved TimTam that taps into a different fan base – that of Taylor Swift. For National TimTam day on February 16, Arnott’s gave away the biscuits at Melbourne airport and other places around the city to coincide with the arrival of Swift fans for her Eras concert tour. While not a long-term launch, the clever rebranding reinforces the status of biscuit, which turns 60 this year, in the Australian consciousness and encourages the idea of brand generosity.

A spokesperson at The Arnott’s Group said: “As Tim Tam enters its 60th year, we continue to witness the power and social currency this incredibly indulgent chocolate biscuit has amongst locals and visitors.

But it’s not just TimTams who are tapping into Swift’s powerful brand following for their NPD. Smirnoff Ice has released a limited-edition Lavender Lemonade to coincide with the arrival of the Lavender Haze singer on Australian soil.

Safety in collaborations

Nestle continued its NPD investment through a series of collaborations in the UK via its recipe box business Mindful Chef. For a limited-time period at the start of the year it partnered with plant-based specialist Deliciously Ella, while also continuing its limited-edition recipe range with high street quick service chain Leon, who were acquired by Asda in the final quarter of 2023.

A squeeze on oranges

According to the Kerry 2024 taste reports, orange’s popularity as an enduring flavour across all the regions isn’t waning. But extreme weather conditions in 2022 - specifically Hurricane Ian in Florida, the US’ biggest orange grower - saw supply drop and prices rise. So, the industry has responded by diversifying the flavour, with the introduction of mandarin as an orange alternative.

In the UK, Coldpress introduced a new Mandarin Orange Juice, with added vitamins. Coldpress founder Andrew Gibb explained the brand’s choice, “Mandarins are a fantastic, low-calorie winter fruit, packed with vitamins and minerals. Alongside vitamin C, which ably supports one’s daily immune system function, mandarins contain two antioxidant phytochemicals (beta-carotene and beta-cryptoxanthin) that your body turns to vitamin A, which supports good vision, a healthy immune system and positive growth development.”

Little Moons have also chosen mandarin as part of a flavour combination for their new Refreshos sorbet line. Available in Asda in the UK, the HFSS-compliant, gluten-free and vegan desserts contain no artificial colouring, flavouring or preservatives and are less than 60 calories a serving.

Described as the “first-to-market mochi sorbet” by the brand, the desserts follow hot on the heels of a very successful year for the brand. In 2022 Little Moons upped its revenues by 233% and won the Food Brand of the Year at the Grocer Gold Awards.

Beverages for the sober-curious

In the US the spotlight has been on the non-alcoholic drinks space. A 2018 Berenberg Research report found that a “sober curious” movement among young adults is leading to them drinking significantly less alcohol than other generations – and a host of young innovative brands are responding.

Some of the new launches, such as Kolonne Null’s Cuvee Blanc Sparkling Magnum, Nice’s Session Wine and Amaro Lucano Non-Alcoholic, are European brands recognising the potential to connect with young consumers – especially Gen Z - in the US market.

But there are US brands expanding in this area as well. Hard seltzer brand White Claw has introduced White Claw 0% Alcohol in four flavours to build a following during dry January. While ready to drink brand Free AF has added a cucumber G&T to its flavour portfolio.

The prize for most innovative non-alcoholic offering goes to Apothekary Wine Down, an alcohol-free herbal tincture designed to emulate red wine, when drunk with sparkling water or juice. Available on a subscribe and save model, ingredients include Californian poppy, orange flower and North American herb blue vervain.

Q1 NPD takeaways

There are three key behaviours emerging at the end of Q1.

- Brands need to listen to consumers and respond with products that fill their need. Even if that need is a feeling of value for money.

- Testing the waters using established products is a safe option at a time when consumer confidence is low.

- Brands shouldn’t be afraid to experiment with alternative flavour options if supply chain disruptions slow production.

Want to learn more about planning your NPD strategy and the consumer behaviours that are influencing it in? Then check out our report on the subject...

.jpg)

Greer McNally

Greer has over 15 years’ experience writing about trends in the food and retail sectors. She lives in a little village by the sea in Northern Ireland and loves creating content that informs how people think about the food industry. A recent career highlight was interviewing the legend that is Dr Temple Grandin.

Stay up to date

Stay up to date

Browse Posts

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

/Blog%20Headers/shutterstock_1927957907%20(1).jpg)

/Blog%20Headers/shutterstock_1845178195%20(2).jpg)

/Blog%20Headers/shutterstock_2133827717%20(1).jpg)

/Blog%20Headers/shutterstock_2473376713.jpg)

/Blog%20Headers/shutterstock_2474442759.jpg)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

.png)

/1.%20HubSpot%20Images/Roger%20New%201a%20(1)%20(1).jpg)

.png)